Worksafe Tasmania recently released its WorkCover Tasmania Board Suggested Industry Premium Rates for 2020/21 report (the Report).

The Report analyses the performance of Tasmania’s Workers Compensation scheme (the Scheme) and the environment it’s operating in, helping the government and industry set premiums and manage risks.

To help our partners and customers understand the Report and what it means to them, we’ve summarised important information including:

- Scheme performance and recommended premium rates

- Claims experience and trends

- Economic and environmental factors.

Key findings and recommendations

- The Report recommended an average industry rate of 2.22% of wages (excluding GST), an increase of 0.14% from the suggested 2019/20 rate.

- Recommended premium rates at the ANZSIC Class level ranged between 0.40% to 9.30% of wages. Around 18% of ANZSIC industry classes had their recommended rate reduced, 7% had no change, and 75% increased.

- The Scheme’s claim frequency rate and average claim size has increased in recent years. These factors were considered in the projections and recommended rates for 2020/21.

- Amendments to Tasmania’s Workers Rehabilitation and Compensation Act 1988 came into effect in January 2018 and impacted the Scheme and claims rates.

- Economic factors including wages and workforce size have a direct impact on the Scheme however the Report noted the COVID-19 pandemic and related economic uncertainties had not been considered in projections and recommended rates.

Scheme performance and premium rates

Scheme performance

The Report confirmed the Scheme has remained generally stable in recent years, showing only moderate changes to the total premiums charged over the last five underwriting years.

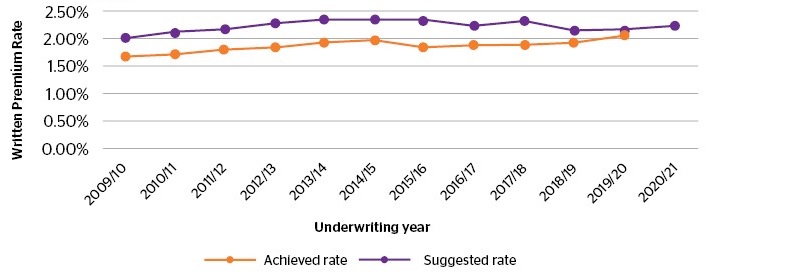

However, data revealed between the 2010 and 2018 underwriting years the achieved premium rate was around 18% below the suggested rate. This means the actual premium charged by insurers was below the amount recommended to cover claims, other costs and margins.

Premium increases by insurers in the 2018/19 and 2019/20 underwriting years have addressed this gap and seen it steadily closing, supporting continued scheme viability for both insurers and customers.

Suggested vs achieved premium rates

Achieved and suggested rates for recent years are preliminary and will change as final premiums and wages are recorded. Suggested rate for 2019/20 and 2020/21 may change when reweighted on actual wages, and the achieved rate for 2018/19 and 2019/20 may change as premium adjustments are received.

Source: Work Cover Tasmania Board Suggested Industry Premium Rates for 2020/2021, 2020

In line with this, and based on key premium drivers, the Report recommended an average 2020/2021 premium rate of 2.22% of wages. This is an increase of 0.14% (a 7% proportionate increase) from the 2019/20 suggested rate of 2.08%

The main drivers of this change included:

- Increases in the average claim size (driven by higher numbers of weekly active claims after the employer excess was removed and claimants staying on weekly benefits for longer than expected).

- Lower discount rates party offset by decreases in assumed claim frequency.

The recommended premium rate was also informed by a number of other factors including wage inflation, superimposed inflation, administration expenses, insurer margins and other economic assumptions.

It’s also important to note insurer data, analysis and objectives also play an important role in actual rates and premiums.

Recommended premium rates - ANZSIC 2006 classes

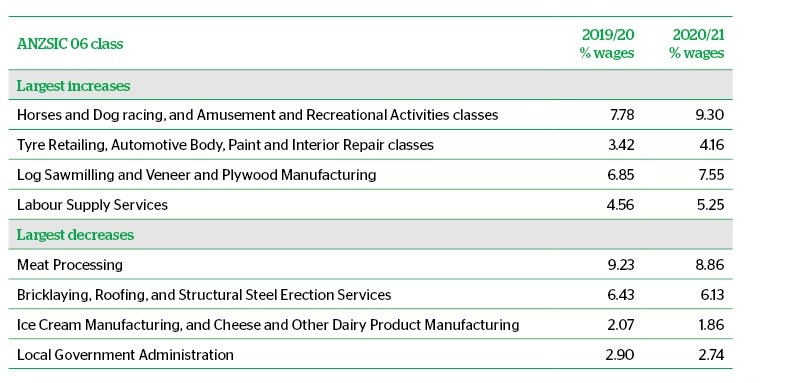

Recommended industry premium rates were also included in the Report. These rates were calculated at the ANZSIC Class level and developed based on the average rate in addition to data and risk analysis specific to each class.

The suggested rates ranged between 0.40% to 9.30% of wages. Of these, around 18% of classes saw a rate reduction, 7% had no change, and 75% increased from the previous year.

ANZSIC classes with the largest increases and decreases in premium

Source: Work Cover Tasmania Board Suggested Industry Premium Rates for 2020/2021, 2020

Claims experience and trends

The Report found the Scheme saw a notable increase in claims frequency (number of claims experienced per million dollars of wages) after the 2018 legislative amendments took effect. The amendments removed the excess payable by employers for claims, and as a result weekly active claims increased.

Since then, the total claim frequency has decreased, but remains above levels experienced in Dec 2017.

The Report projected there would be 6,402 total claims for estimated wages of $10.1 billion in 20/21 (based on an estimate of 0.63 claims per $1 million in wages).

Notably, this is higher than the two most recent accident half years and driven by strong actual and assumed wage growth.

The Report also noted average payment size was higher than expected for the last two accident half years, mainly driven by weekly claims staying on benefit for longer. In line with this and other key considerations, the Report estimated an average claim size for 2020/21 of $21,929.

Economic and other influencing factors

Legislative changes

Tasmania’s Workers Rehabilitation and Compensation Act 1988 came into was effect from 1 January 2018. Key amendments included:

- Removal of the employer excess for the first weekly payment, and the first $200 of other benefits payable, removing costs and administration barriers for employers.

- A requirement for employers to insure the full amount of their liabilities.

- Removal of age restrictions for weekly benefits (replaced with a link to the Social Securities Act 1991), ensuring there’s no gap in weekly compensation entitlements when payments stops due to age and when Age Pension entitlements begin.

These changes were considered in the Report’s projections and recommended premium rates.

The Report also summarised a number of proposed amendments under consideration including:

- Expansion of public sector provisions for PTSD claims to the private sector.

- A review which would relax age restrictions relating to maximum benefit entitlement periods.

- A review of step-down provisions for weekly benefits.

Economic growth and wages

The Report revealed 2018/19 saw economic growth of 3.6%. According to estimates from the Tasmanian Treasury at the time, the projected future a growth rate is 3% for 2019/20, and 2% for 2020/21.

It credited consumer and public spending, with a contribution from private investments the main drivers behind this growth and Tasmania’s economic performance in 2018/2019.

The Report however used a projected 2020/21 growth rate of 2.0% per annum to inform the 2020/21 recommended premium rates. This rate recognised the flat economic outlook across Australia and globally, together with the fact that actual licensed insurer sector wages have been higher than expected over the last twelve months.

The Report also projected increased written wages of $10.1 billion for the 2020/21 underwriting year.

Notably, these economic and wage projections informed the 20201/21 recommended premium rates.

Economic impact and COVID-19

The COVID-19 pandemic has caused significant uncertainty to Australia’s economic future. The Report noted these uncertainties had not been considered in its projections or recommended premiums.

The Report did however acknowledge the pandemic had made and would continue to make a significant impact on Australia’s workforce, and economic activity. It also acknowledged that changes to working arrangements resulting from Government intervention will likely temporarily change the Scheme’s emerging claims experience.

For more information specific to COVID-19 and its impact to Workers Compensation in Tasmania from WorkSafe please visit their COVID-19 Resource Centre.

Find out more

Read the full Report or visit the WorkSafe Tasmania website to find out more about Workers Compensation in Tasmania.

For more information on our Workers Compensation offering, or a personalised analysis of what the Report findings or recent changes might mean for your business, please get in touch with your QBE Business Relationship Manager or broker.

Download a pdf version of this report

Please note this is a summary of selected information only. The full WorkCover Tasmania Board Suggested Industry Premium Rates for 2020/21 should be read to understand findings, projections and data in full context.

The advice in this article is general in nature and has been prepared without taking into account your objectives, financial situation or needs. You must decide whether or not it is appropriate, in light of your own circumstances, to act on this advice.