Revealed: Australia’s SME insurance habits

Most Aussie small business owners aren’t sure if their insurance is the right fit anymore.

And 87% agreed that a business liability claim has the potential to put them out of business.

Australian small business owners also said they’d lose revenue, clients or even their entire businesses if someone made a liability claim against them.

And if faced with a liability claim, the majority would likely run up large personal debts to pay these, with 33 per cent admitting to simply not knowing where the money would come from or being unable to finance the legal costs.

That’s according to The QBE SMEs and Insurance Report, which surveyed over 600 Australian SMEs on their insurance habits.

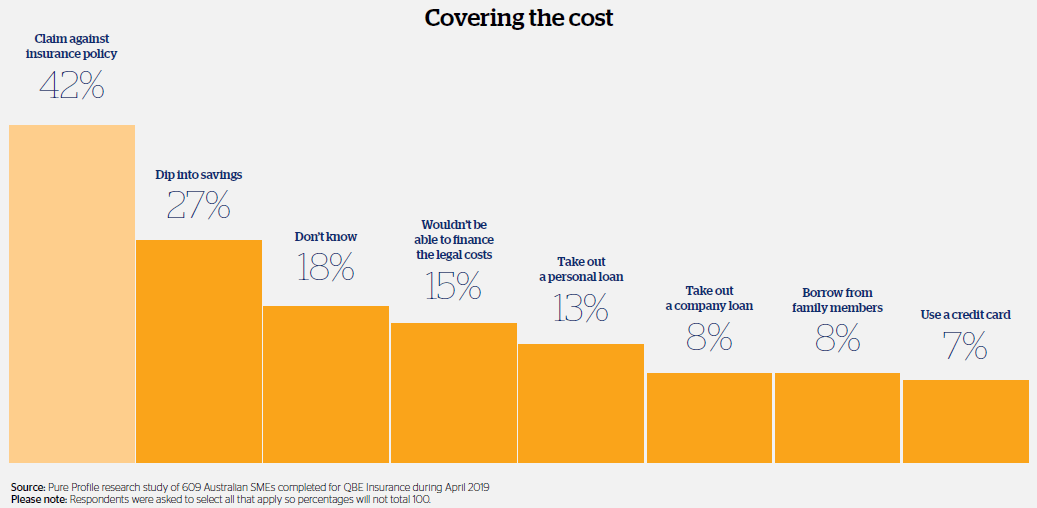

Paying for a claim

How would you pay for a claim if an incident happened?

The majority of SMEs surveyed revealed they would likely run up large personal debts if they had to pay for claims themselves without insurance.

These debts range from taking out a personal loan to using a credit card, from dipping into savings to simply not knowing where the money would come from.

And the financial strain could be enough to put them out of business.

Being under-insured or having inadequate coverage could be disastrous to a small business owner if a liability claim were made against them.

But the knock-on effects of a business liability claim could also shut them down. For example, of the SMEs surveyed by QBE, 46 per cent also said losing clients was the biggest risk to their cash flow. And 15 percent said a liability claim against them or their business was the biggest risk to their cash flow.

A business simply can’t survive if it loses its revenue and clients. And if you lack the right coverage, a liability claim can expose your business to these very real risks.

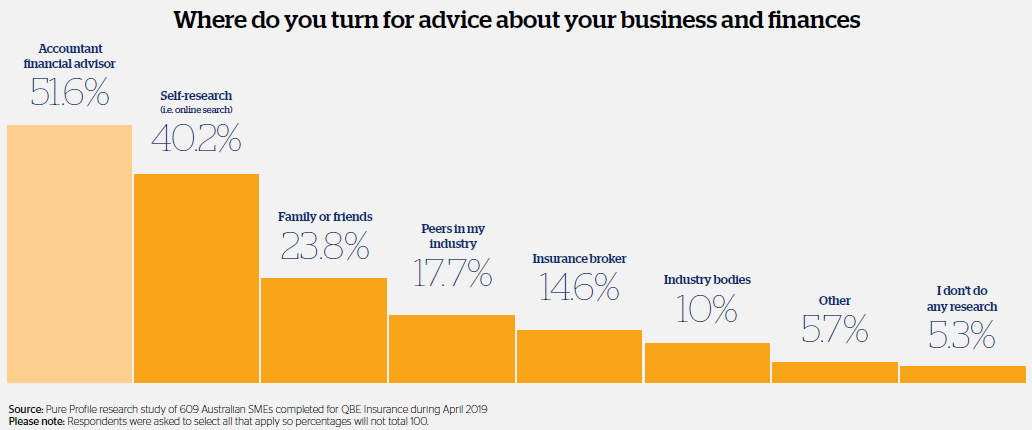

Where do you turn for advice about insuring your business?

At some point soon, make time to talk with a dedicated insurance advisor about the right coverage for your business.

Most people turn to the internet first when looking for insurance advice. But most of the information you might find online is very general, because it’s designed for a broad audience.

And chats with industry peers can only get you so far because even the same types of businesses have different ways of working, different equipment and different risks that all need to be covered.

So if you want personalised advice that’s explicitly about your business and its insurance needs, talk with an insurance broker. Getting the right insurance cover could be the difference between recovering well from an incident – or not.

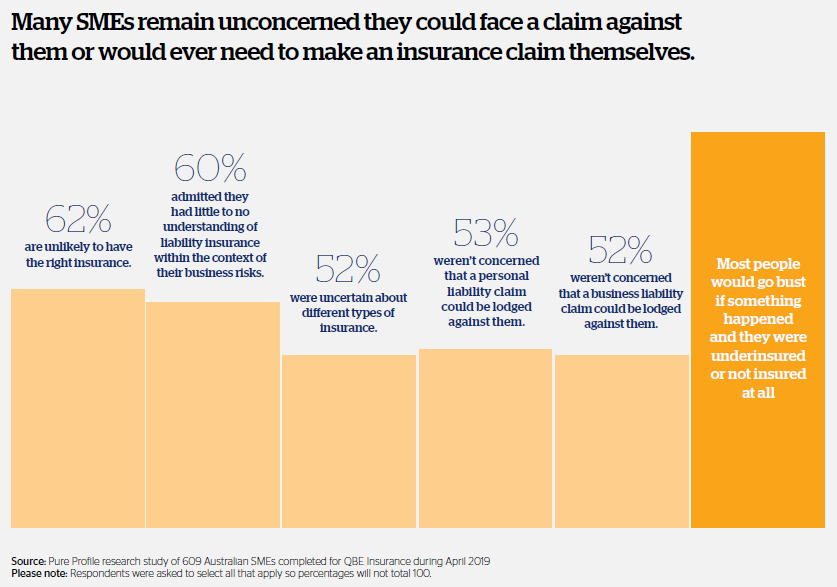

How concerned are Australian SMEs about the potential of a claim?

Many SMEs remain unconcerned they could face a claim against them or would ever need to make an insurance claim themselves.

You can’t put a price on peace of mind

Some small businesses don’t take out insurance when they’re starting up because of the perceived high cost of the coverage. And, more than half the SMEs surveyed by QBE aren’t worried about being the subject of a business liability claim.

But as Aaron Gavin from QBE, and Brigid Shute, CEO of HaloGo a QBE liability insurance customer explain, not only is the cost of insurance worth it, having it might just save your business from closing for good.

The key to getting the right liability coverage is to know your business and to know the risks, explains Aaron Gavin, QBE General Manager, Small to Medium Enterprises.

“If they’re starting a business, then most people work out pretty quickly, through basic research and/or speaking to other business owners, that they need a liability cover.”

“Liability is the bit that is easiest to understand. If I’m liable for damage or injury to another individual or other people’s property, then I need to make sure I’ve got that cover and that peace of mind.”

“If I’ve got a business that has some computers and I lose them, I know I can replace them and it probably doesn’t put me out of business. But if someone gets injured or I provide advice that exposes me, well in that instance, it could put me out of business.”

_________________________________________________________________________

1Pureprofile research study of 609 Australian SMEs completed for QBE Insurance during April 2019