Qnect | Agency Portal | 24 Apr 2020

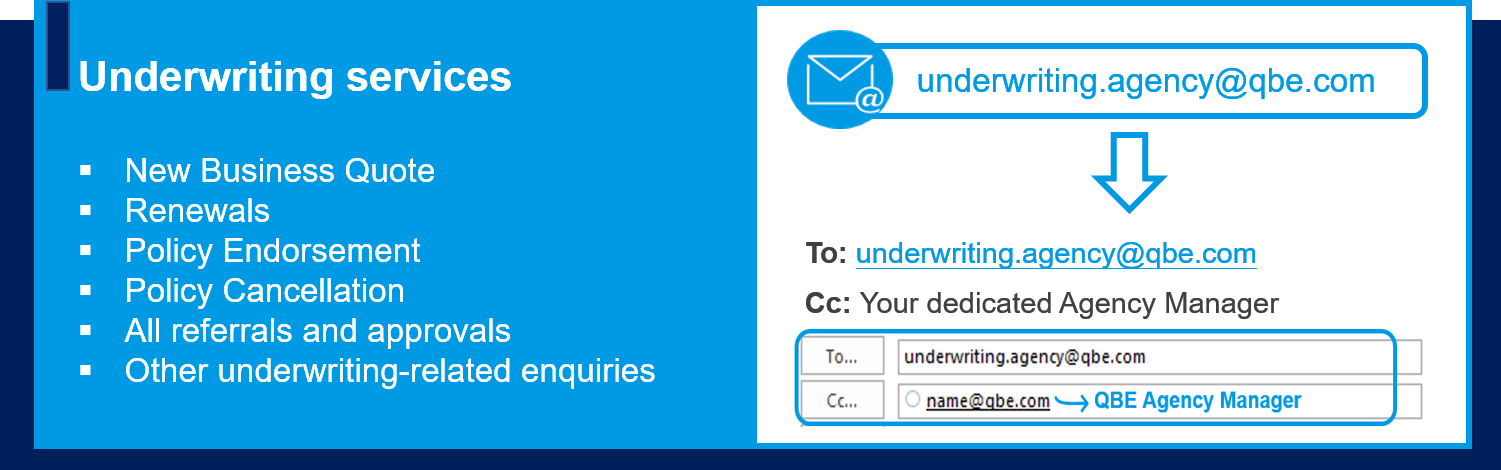

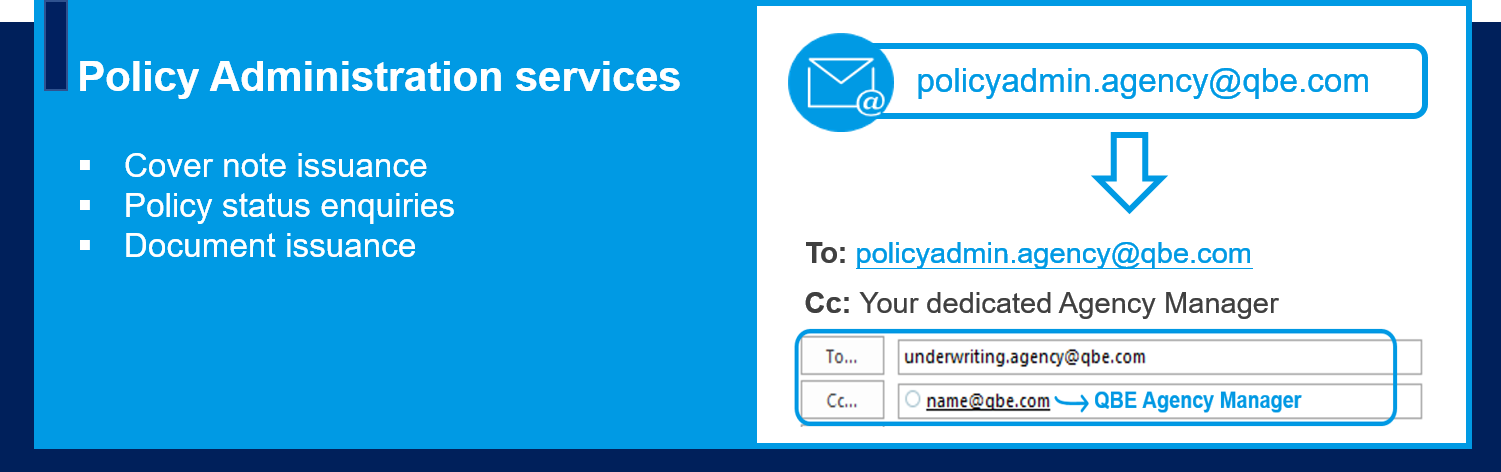

It is our mandate to put your business in the fast lane. We have introduced the Centralized Mailbox (underwriting.agency@qbe.com and policyadmin.agency@qbe.com) since August 2019 and we definitely receive your great support.

The Centralized Mailbox allows us to keep track the communication chain and re-enforce our operations, and most importantly, bring about improved service response time for our Underwriting and Policy Administration services. Ultimately, our goal is to deliver a better experience for our business partners as well as customers.

Please send your insurance service requests to the Centralized Mailbox for Underwriting services and Policy Administration services, copying your dedicated Agency Manager.

All requests sent to the Centralized Mailbox will be triaged to the appropriate underwriters or the policy administration team.

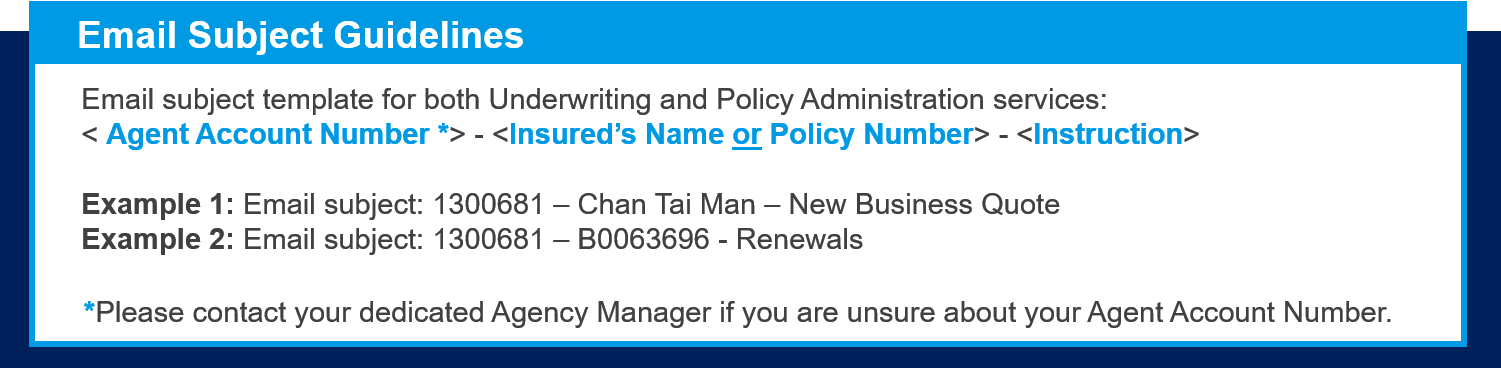

To speed up your request, please kindly follow the Email Subject Guidelines below to ensure your request is processed in a timely manner.

In view of the recent coronavirus outbreak, Insurance Authority has decided that, as a one-off facilitative measure, individual licensees will be considered as CPD-compliant for the first CPD Assessment Period if they can earn the CPD hours required on or before 31 October 2020 and must report their CPD compliance to the IA no later than 31 December 2020.

For details, please visit:

English: https://www.ia.org.hk/en/supervision/reg_ins_intermediaries/cpd.html

Chinese: https://www.ia.org.hk/tc/supervision/reg_ins_intermediaries/cpd.html

In many property policies there is a condition on the unoccupancy of the insured premises. As a result of the government restrictions and orders we will not be applying this policy condition for the period of required closure by the authorities.

We also recognise that the enforced closures are not the sole reason for closure. If as a result of the impacts of Covid-19 you are still unable to resume operations and the insured premises remains closed, we are prepared to consider further waiver of the policy conditions upon written request from the insured.

Our intent is not to waive the conditions due to normal trading and occupancy during business as usual but recognise that these are difficult conditions for our customers and each case is different. Should any premises continue to remain unoccupied for a period of 7 days after any applicable restrictions are lifted we would consider any such property to be subject to the unoccupied building conditions.

If during the Covid-19 outbreak, the insured repurposes the premises to undertake different activities please have the insured contact the agent, broker or QBE for further discussion.

Having temporarily unoccupied buildings or businesses is not a desirable situation at any time. There are dangers that routine maintenance and management programmes are deferred and have the potential to increase frequency and severity of loss. There are however some basic steps that can be taken to reduce the hazards.

The Risk Management Guidance on Unoccupied Risks (English) and (Chinese)

We’re here for you!

As always, we welcome your feedback. Contact your respective Agency Manager whom will be very happy to hear from you!