Mid-sized companies cite natural disasters as the top climate change risk, but most lack a risk mitigation strategy

By Paul Isaac, SVP, Head of Global Risk Solutions, QBE North America

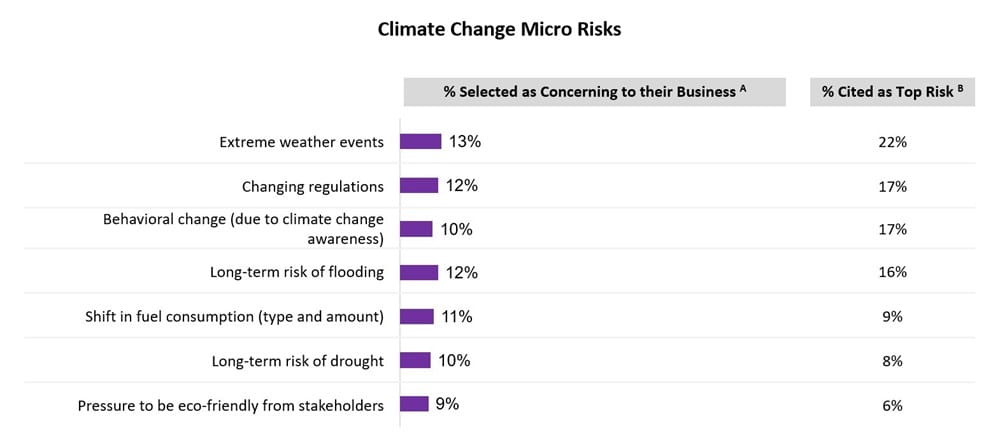

As if the impact of COVID-19 wasn’t enough, the U.S. in 2020 has already seen record setting wildfires in California, disastrous tornadoes in Tennessee, a derecho in the Midwest, and a highly active Atlantic hurricane season. For mid-size companies in the U.S., the risk that these types of events may be growing more common and extreme tops their list of concerns about the impact climate change could have on their business, according to QBE North America’s Mid-Sized Company Risk Report.

The concern is well founded and not just limited to the areas of the country typically associated with natural disasters. NASA notes a variety of regional effects in the U.S. linked to increased hurricanes, flooding, droughts and heat waves that have been ongoing and could worsen. Extreme weather in 2020 is only the most recent demonstration that a wide variety of natural disasters can inhibit a company’s ability to conduct business.

These trends raise the importance of disaster planning along with proper insurance for mid-size companies. Yet, 60% of these companies reported that they did not have a risk mitigation strategy for natural disasters / severe weather, according to the QBE Risk Report.

This widespread lack of preparation may reflect that mid-size companies often don’t have the scale to support a dedicated internal risk management team, unlike large companies. Regardless of company size, effective disaster and/or emergency preparedness planning requires senior leadership commitment and can play a key role in a company’s resiliency.

At its very basic level, emergency preparedness planning describes ways of protecting the life, property, assets of a company, and the ability of the company to continue day-to-day operations. Developing the plans takes time and collaboration between different individuals within and outside of the company.

Some basic questions to consider about natural disasters include:

- What natural hazards (fire, flood, earthquake, windstorm) is the business exposed to, and how likely are they to occur?

- Which of these hazards is the company’s supply chain exposed to?

- What impact would each disaster have on the company’s ability to run the business, including the inability to access facilities for an extended period of time?

- From a timing of event occurrence standpoint, when is the business most vulnerable to interruption of business operations?

- What procedures and plans exist to safeguard property, customers and employees before, during and after each disaster?

- What insurance protection does the company have for natural disasters related to property damage, liability, workers compensation, business interruption, and trade credit for receivables.

Asking the questions is the start. Answering them and developing procedures and plans is the critical next step. A company’s insurance broker and/or carrier risk control staff can be a great resource to assist in planning efforts – not only for natural disasters but also for other hazards such as civil unrest, health emergencies, active shooters and more. They can facilitate preparedness planning meetings and guide company staff through the planning process. Companies can learn more about QBE’s capabilities and disaster preparedness resources at QBE’s Risk Solutions Center.

Climate change and regulatory risk

Concern about changing regulations due to climate change also ranked highly as a cause for concern among mid-size companies. This could include a variety of areas such as fuel use, energy costs, carbon taxation and more.

One area that directly impacts insurance is green building codes. If a company building became damaged due to a covered loss, the cost of rebuilding could be significantly higher than expected because of the need to upgrade the building to the latest codes. For this reason, companies should be sure to work with their brokers and carriers to make sure coverage terms and proper limits exist for the added cost of upgrading the building to code.