The results of our materiality assessment inform our sustainability approach, strategic priorities and reporting. QBE undertakes a full materiality assessment every two years, with a desktop review in interim years. In 2023, we refreshed our material topics to better reflect the current reporting landscape and frameworks, and to prepare for emerging reporting requirements.

Aligned to the Global Reporting Initiative (GRI) Standards, our materiality assessment considers our economic, environmental and social impacts across the value chain (including positive, negative, actual and potential) on stakeholders, society at large and on our business.

2023 Materiality Assessment

In 2023, we refreshed our materiality topics and reduced them from 38 to 20. The top 2 material topics relate to climate and natural disasters, with the third topic of responsible technology and data, as exposures to risks and opportunities associated with AI increase alongside complex and sophisticated threats such as cyberattacks. The refreshed materiality matrix is below:

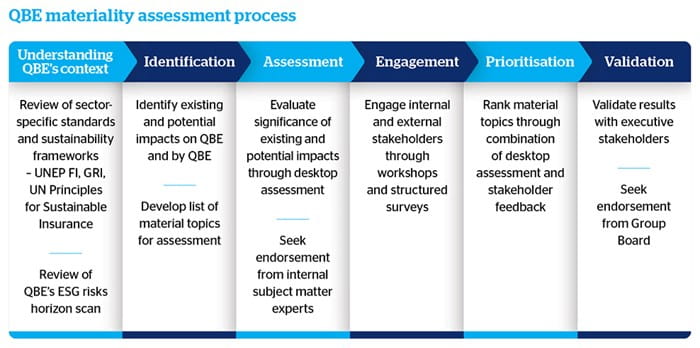

The following provides an overview of the key aspects of the full materiality assessment methodology carried out in 2023:

We performed a business impact assessment on the 20 impact areas, using our Incident and Issue Management standards to assess the:

- Scale of impact on QBE (Financial, Reputational, People, Regulatory, Business Disruption);

- Scope of QBE's impact;

- Management difficulty to realise opportunities/mitigate risks; and

- Timing of when impacts become material.

The topics were also tested with internal subject matter experts (SMEs) for their input on the appropriateness of the topics and their definitions.

We surveyed a wide range of internal and external stakeholders to assess the severity of the impact areas to QBE’s operations. More than 1700 employees participated in the online survey, a response rate of approximately 13.5%.

External stakeholders included investors, brokers, suppliers, partners, Premiums4Good customers, NGOs, government and other stakeholders. Over 70 external stakeholders provided feedback on the impacts of the list of sustainability topics.

Through a structured online survey, we asked respondents to rank the 20 impact areas through two separate lenses:

- ‘How important do you think the following impact areas are for QBE to achieve its purpose and strategy?’ (i.e., (financial) impact on QBE).

- ‘Where could QBE have the most impact on society?’ (i.e., impact through QBE).

We conducted supplementary interviews with executives to enrich the survey results. The interviews explored the reasoning for the respondents' ranking choices, opportunities and risks for these areas, and improvements.

We combined the results from the external and internal surveys and calibrated with the outputs of the business impact assessment.

The results are reflected in the updated materiality matrix. Each topic is positioned on our revised matrix with the ‘Impact on QBE’ score against the x-axis, and the ‘Impact through QBE’ score mapped against the y-axis. The clusters of topics are consistent with the three different stages of relevance and maturity:

Priority – Topics of high importance to our stakeholders, with a significant impact on the environment, economy and society. These require significant management and strategic focus.

Ongoing and emerging importance – Topics of strategic significance for which we have well-established management processes, or where topics have increased in importance since the last reporting period Stakeholder interest in these topics may vary.

Monitor– Topics of relevance to our stakeholders. Several of these topics will benefit from activities related to the Priority and Ongoing Importance topics. While not primary priorities, they are monitored for issues and opportunities that may elevate their materiality

On completion of the revised materiality matrix, as part of validation process, we held discussions with the executive management. During discussions they were asked to rate the five most important impact areas which QBE should focus on keeping in mind both impacts on QBE and through QBE’s business.

The final matrix was approved by the Group Executive Committee and the Group Board.

|

Impact area 2022 |

Impact area 2023 |

|

Biodiversity |

Biodiversity & ecosystems |

|

Climate risks and opportunities |

Climate change transition & emissions reduction |

|

Operational environmental management |

|

|

Not considered in 2022. |

Waste management |

|

Not considered in 2022. |

Animal welfare |

|

Not considered in 2022. |

Indigenous rights & culture |

|

Financial inclusion |

Equity, poverty & financial Inclusion |

|

Financial crime |

Political & economic stability |

|

Culture |

Organisational culture & inclusion |

|

Diversity & Inclusion |

|

|

Trust & transparency |

Accountable & transparent business |

|

Sustainability & business strategy alignment |

|

|

Corporate governance & compliance |

|

|

COVID-19 business impact |

|

|

ESG risk management |

|

|

Performance & reward |

Thriving workforce |

|

Learning & development |

|

|

Employee engagement |

|

|

Employee relations |

|

|

Workplace adaptation |

|

|

Leadership & talent |

|

|

Health, safety & wellbeing |

|

|

Public Policy & advocacy |

Sustainable & responsible policies, positions & advocacy |

|

Regulatory management |

|

|

Responsible underwriting |

|

|

Sustainable procurement |

|

|

Responsible investments |

|

|

Impact investment |

|

|

Community engagement & collaboration |

|

|

Community investment |

|

|

Customer conduct |

Responsible products & services |

|

Customer-centric solutions |

|

|

Sustainable solutions |

|

|

Customer service & satisfaction |

|

|

Not considered in 2022. |

Fundamental labour standards |

|

Affordability & accessibility |

Fundamental living standards |

|

Affordability & accessibility |

Housing access & affordability |

|

Human rights & modern slavery |

Human rights & forced migration |

|

Human rights & modern slavery |

Modern slavery |

|

Community resilience & disaster support |

Natural disaster resilience |

|

Not considered in 2022. |

Infrastructure & public services |

|

Data & analytics |

Responsible technology & data |

QBE Re

QBE Re

Hong Kong

Hong Kong

India

India

Macau

Macau

Mainland China

Mainland China

Malaysia

Malaysia

Philippines

Philippines

Singapore

Singapore

Vietnam

Vietnam

Australia

Australia

New Zealand

New Zealand

Denmark

Denmark

France

France

Germany

Germany

Italy

Italy

Netherlands

Netherlands

Spain

Spain

Sweden

Sweden

UK

UK

United Arab Emirates

United Arab Emirates

Canada

Canada

USA

USA

Pacific Islands

Pacific Islands

Fiji

Fiji

French Polynesia

French Polynesia

Solomon Islands

Solomon Islands

Vanuatu

Vanuatu