Our role in the global sustainable development agenda

We support the aims and objectives of the United Nations Sustainable Development Goals (SDGs), which seek to address the world’s most urgent economic, environmental and social challenges and form part of a wider 2050 Agenda for Sustainable Development. As a universal agreement to work towards a better and more sustainable future, the SDGs closely align with our purpose – enabling a more resilient future. Our sustainability focus areas align to and support the advancement of the SDGs.

SDG analysis

In 2020, we conducted a deep dive SDG prioritisation analysis to assess continued relevance to our business and stakeholders. The analysis was updated for all 17 SDGs to reconfirm those most closely aligned to our purpose, strategic business priorities, Sustainability Framework, products and services and initiatives across our global business. We used two lenses for this analysis:

Direct and indirect impacts of the SDGs on our business and stakeholders, including our people, customers and community.

Opportunities to contribute to the achievement of the SDGs through our products and services, advice, thought leadership and community initiatives.

Our analysis by division (Australia Pacific, North America and International) considered strategic priorities, business activities and product lines. We then engaged with senior members of our divisions to review and agree key insights. This process helped identify nuances enabling us to prioritise our efforts at both a local and global level.

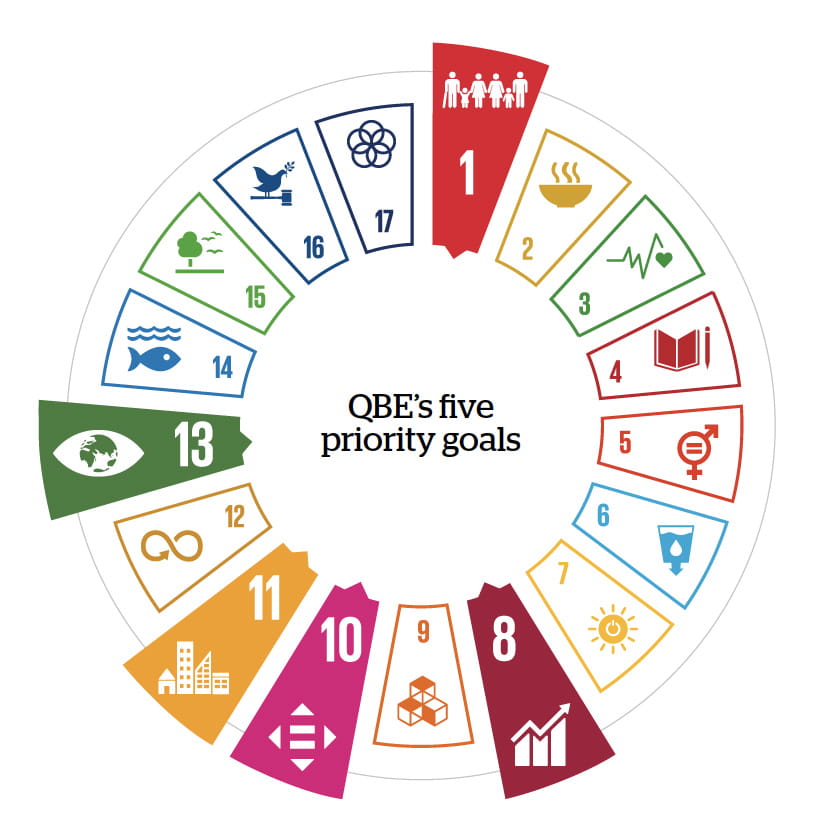

We acknowledge that all of the SDGs are relevant to our business in some way. However, we can contribute to the achievement of some SDGs more directly than to others. In 2023, we continued to address our five priority SDGs (outlined below), which reflect the areas that most closely align to our purpose and strategic business priorities. This is where we can have the greatest impact given our role as an international insurer and reinsurer.

Alongside our five priority SDG, Goal 17: Partnerships for the Goals continues to underpin our stakeholder engagement, assisting us to work towards achievement of the wider 2030 Agenda for Sustainable Development. In 2020, we joined the United Nations Global Compact, the global corporate sustainability initiative, and committed to the Ten Principles on human rights, labour, environment and anti-corruption. We are also signatories to the Net-Zero Asset Owner Alliance (NZAOA) and a supporter of the Climate Change Roadmap Towards a Net-Zero and Resilient Future (Roadmap) of the Insurance Council of Australia (ICA) in our home market.

We will continue to leverage our partnerships to collaborate on key sustainability topics, and seek to collaborate with industry, government, community partners and other stakeholders to help advance, and one day achieve, the SDGs.

Our Five Priority SDGs

Building the financial and risk resilience of our customers is core to our purpose. We seek to protect people, businesses and communities against risks - contributing to their long-term financial wellbeing. An accident, illness or disaster can quickly plunge customers into financial distress. Providing insurance protection for customers and communities helps aid recovery, preventing them from falling into, or deeper into, poverty.

In 2023, QBE Australia embarked on a second iteration of our Financial Inclusion Action Plan (FIAP), refreshing existing commitments and incorporating new programs of work as part of our ongoing commitment to financial inclusion. The plan incorporates 25 initiatives aimed at improving financial inclusion, resilience and wellbeing for our employees, customers, community, partners and suppliers. Examples include embedding the use of an Interpreter & Translator Panel to support vulnerable customers and improve accessibility for cultural and linguistically diverse customers; and enhancing training across QBE front-line employees and their leaders with respect to identifying and supporting customers experiencing vulnerability.

On the United Nations’ International Day for Disaster Risk Reduction in October 2022, we relaunched our global Disaster Relief and Resilience Partnership with Red Cross and Save the Children committing to a further three years of working with each partner and increased funding. The vision is that QBE, in partnership with Save the Children and Red Cross, is helping communities to build their resilience and save lives by improving their capacity to prepare, anticipate, respond and recover from disasters. Since inception, US$4.6million in QBE funding has supported the partnership’s activation in 21 countries through 71 initiatives, supporting 25,559 families/households. Among the key outcomes and impacts is 22 preparedness programs implemented in communities, providing tools and resources for disaster preparedness. Over the next three years, we are working towards growing our focus on climate risk adaptation and mitigation.

Material topics: ‘Climate change transition and emissions reduction’, ‘Modern slavery’, ‘Equity, poverty and financial inclusion’, ‘Fundamental labour standards’, ‘Fundamental living standards’

With operations in key markets internationally, we believe that inclusive and sustainable economic growth is fundamental to our business and our success. Our strategic focus on innovation and technology enables us to promote economic growth that is impactful. We provide insurance products supportive of decent work, such as our workers’ compensation and accident and health solutions. A continued focus on protecting labour and human rights within our business, and across our supply chain, is essential to ensuring that we remain a responsible employer and business partner. In 2023, we refreshed our Group Human Rights Policy outlining the guiding principles we are committed to adhering to as part of our role as an employer, insurer, investor, in our supply chain and communities. . The Policy outlines how we manage various human rights topics including modern slavery across the enterprise. QBE’s Modern Slavery and Human Trafficking Statement outlines the steps we have taken during the reporting period to address modern slavery across our operations and supply chain.

Material topics: ‘Accountable & transparent business’, ‘Organisational culture & inclusion’, ‘Thriving workforce’, ‘Modern slavery’, ‘Responsible technology & data’, ‘Fundamental labour standards’, and ‘Fundamental living standards’

QBE is committed to an inclusive culture as part of our QBE DNA and aligned to our Inclusion of Diversity Policy. We seek to empower and promote equality and the inclusion of all, irrespective of age, gender, ability, ethnicity, origin, religion, economic or other status. Wherever we operate we respect internationally recognised human rights principles and we retain a strong strategic focus on inclusion of diversity across our business.

In 2023, we achieved our 2025 target of 40% Women in Leadership1 across QBE early, with an increase over last year from 38.6% to 40.0%. We continue to focus on women in leadership to maintain this result. QBE also continued to meet our 2025 goal of 40% women on the Group Board. In 2022, we pledged support for the industry-led 40:40 Vision, with a goal to meet the principle of 40% women, 40% men and 20% any gender on the Group Executive Committee (GEC) by 2025, a target we currently meet with 55% women on our GEC.

Material topics: ‘Organisational culture & inclusion’, ‘Responsible technology & data’, ‘Modern slavery’, ‘Accountable & transparent business’, ‘Fundamental labour standards’, ‘Fundamental living standards’, ‘Human rights & forced migration’

1Level 0 (GEC) and the next 3 tiers of employees

We understand that cities are rapidly changing and under pressure due to increasing urbanization, changing transport and energy systems, building codes and exposure to climate and health risks. We are committed to building on our existing data, products, services, initiatives and advice, and collaborating with industry, government and other stakeholders to identify sustainable solutions to reduce risk and enhance inclusion, safety and resilience.

Each year, we partner with Leading Cities and provide financial and non-financial support to the QBE AcceliCITY Resilience Challenge, a global competition seeking entrepreneurs whose ventures drive resiliency in cities.

In 2023, we expanded two additional tracks — the Insurance Track and the Agriculture Track - focusing on loss mitigation solutions for the commercial property sector and assisting small to mid-size farms to embed sustainable solutions. This year, itselectric won the challenge's grand prize of $100,000 to elevate its technology and services. The US-based company addresses the challenges of electric vehicle (EV) adoption by focusing on expanding and enhancing EV infrastructure through partnerships with private building owners. The People’s Choice Event saw our employees vote and award two additional $25,000 prizes – again to itselectric, and to Syrinx, an Australian-based mobile wastewater treatment technology using local plants and biosorbents to remove pollutants from local water sources.

Material topics: ‘Climate change transition & emissions reduction,’ ‘Responsible technology & data,’ ‘Infrastructure & public services’

Take urgent action to combat climate change and its impacts

As a general insurer, we see first-hand the impacts of a changing climate on our customers, communities and partners. We recognise the importance of addressing climate change and incorporating climate-related risk and opportunities into our decision-making, facilitating a resilient future for our business and our customers. We are well-positioned to use our industry expertise to help customers, partners and communities mitigate these risks in the transition to a net-zero economy, in line with the 2015 Paris Agreement.

QBE has made net-zero commitments for our own operations by 2030, and our investment and underwriting portfolios by 2050. Through these commitments we seek to contribute to the reduction of real-world emissions to mitigate the level of warming this century, and the most severe risks to our customers, society, economy and environment.

We continue to refine our approach to how we foster an orderly and inclusive transition, support our customers and communities and support the global transition to a net-zero economy through our underwriting strategy. Our net zero in underwriting strategy focuses on three important areas:

- Customer engagement and insights: understanding our priority customers’ net-zero ambitions and plans.

- Innovation products and services: exploring opportunities to further expand our offerings in support of the transition.

- Emissions modelling and tracking: understanding and tracking the emissions of our underwriting portfolio and how we can identify and address material data gaps.

To deliver on our commitment to transition our investment portfolio to net zero by 2050, In 2021, we established intermediate targets for 2025, in line with the target-setting protocol of the NZAOA and our commitment to transition our investment portfolios to net zero emissions by 2050. QBE continues to make progress on our 2025 intermediate targets through emissions reductions engagement with investee companies and asset managers, and allocating capital to climate solutions which supports QBE’s strategy to transition to a net-zero economy.

In 2022, we extended our commitment to net-zero across our operations from Scope 1 and 2, to include material scope 3 emissions by 2030. In 2023, we progressed our commitment to net zero by 2030 for our global operations, forming working groups across each of our divisions to identify further initiatives to reduce our operational emissions. We continued to transition our fleet to low-emissions vehicles, where infrastructure is available to do so, and to optimise our office space, releasing surplus floorspace and improving resource efficiency, where possible.

In 2023, we began climate-related discussions with strategic suppliers across our global supply chain, centred around climate risks and opportunities and measuring and reducing emissions. Strategic suppliers were selected, based on QBE’s annual spend and importance to QBE’s operations.

Through this engagement we have identified several emission reduction opportunities that are being explored within the business. Going forward, we are focusing on addressing these opportunities and working to set targets for these suppliers by the end of 2025.

Material topics: ‘Climate change transition & emissions reduction’, ‘Natural disaster resilience’, ‘Responsible technology & data’

QBE Re

QBE Re

Hong Kong

Hong Kong

India

India

Macau

Macau

Mainland China

Mainland China

Malaysia

Malaysia

Philippines

Philippines

Singapore

Singapore

Vietnam

Vietnam

Australia

Australia

New Zealand

New Zealand

Denmark

Denmark

France

France

Germany

Germany

Italy

Italy

Netherlands

Netherlands

Spain

Spain

Sweden

Sweden

UK

UK

United Arab Emirates

United Arab Emirates

Canada

Canada

USA

USA

Pacific Islands

Pacific Islands

Fiji

Fiji

French Polynesia

French Polynesia

Solomon Islands

Solomon Islands

Vanuatu

Vanuatu