The most common reasons for business vehicle accidents — and how to avoid them

- The temperament of drivers is a huge factor in fleet vehicle accidents

- Rushing to meet deadlines is the most common reason for accidents

- Driver training and education can have a significant benefit for businesses.

While many of us are well accustomed to driving vehicles in our personal lives, driving for work is a different proposition.

Though the practical driving skills are the same, other factors come into play when driving for work.

Here are the most common reasons for vehicle accidents occurring at work and what businesses can do to avoid them, according to QBE’s Robert DiPierdomenico, National Risk Manager Commercial Motor and Ken Arthur, National Risk Manager in Commercial Motor.

1. Rushing and deadlines

We’ve all been there at work — rushing around to get 101 things done, with deadlines looming.

“When it comes to businesses and vehicles running into the back of others — 99% of the time it’s due to people rushing and sitting too close to the car in front,” says DiPierdomenico.

If a business is lodging numerous rear-end claims, it’s a concern because, these incidents have a significant impact on costs for a business beyond the claim excess that can’t be recovered. This can include downtime, admin time and damaged stock.

“In many cases, these hidden expenses cost a business between three and eight times what they pay for the claim. That’s significant.”

Rear-ending isn’t the only consequence of rushing. Many accidents happen at low speed — in car parks, for example — when people are in a hurry to perhaps get to a meeting or make it back to work. Therefore, it’s no surprise a driver reversing into another vehicle or object is one of the most common claims we see, says DiPierdomenico.

“During workplace vehicle safety training sessions, we conduct with customers, we set up a car park maneuvering exercise, reversing out of and back into cones,” says DiPierdomenico.

“Part of the way through, we put the drivers into a time pressure situation, and it’s amazing to see the impact time stress has on their driving — cones go flying!”

2. Distractions

During the workday, business owners and employees are often juggling a variety of responsibilities while travelling from one location to the next. Their minds might be focused on prioritising tasks or talking to colleagues or customers on the phone.

This can mean a driver’s focus isn’t always where it needs to be, says DiPierdomenico.

“The mobile phone is the leading distraction risk for fleets.”

“When we do training, drivers say mobile phones are an issue, often because management is calling them while driving.”

But calls aren’t the sole reason for phone-related incidents.

DiPierdomenico recalls a situation where a customer had a number of claims occurring at around 9am.

After investigating, we discovered delivery drivers were expected on the road by 9am, so they all jumped in their vehicles right on 9, set off — and typed their destination into their phone while driving.

It was the proverbial accident waiting to happen.

3. Lack of care

Subconsciously at least, people are likely to take more care when driving their own car.

When the car and insurance is their own and an at-fault accident occurs, the driver is not only typically going to be responsible for the insurance claim, they’ll need to pay the excess and potentially face losing their no claims record too.

“If the driver doesn’t care about the vehicle, or isn’t held accountable, they’re likely to have more accidents in my experience,” says DiPierdomenico.

4. Ego and temperament

“Every time a driver gets behind a wheel and drives off-site, they’re entering a dynamic world over which, in many circumstances, they have no control,” says Arthur.

Weather, other drivers, road conditions, fatigue, driver temperament, delays and pedestrians are just a few variables drivers encounter. However, the temperament of the driver is critically important.

“We ask every group of drivers ‘are you a good driver’ and everyone says they are average or above,” says Arthur.

“There’s the problem — that’s statistically impossible.” According to Arthur, people often perceive experience, awareness, skill and luck to be factors that contribute to their prowess as drivers, but in reality, temperament is far more influential.

Improving driving — and reducing accidents

Identifying repeat causes of accidents, understanding why they occur, then educating drivers on how they can be avoided can significantly reduce a business’ risk, says Arthur.

Some reasons for accidents — rushing, distractions and a lack of care — are theoretically simple to address within a business, once identified and supported by further training.

For example, the incidents occurring at 9am could be avoided by changing the habits the drivers had fallen into.

However, driver temperament is often more difficult to address and change.

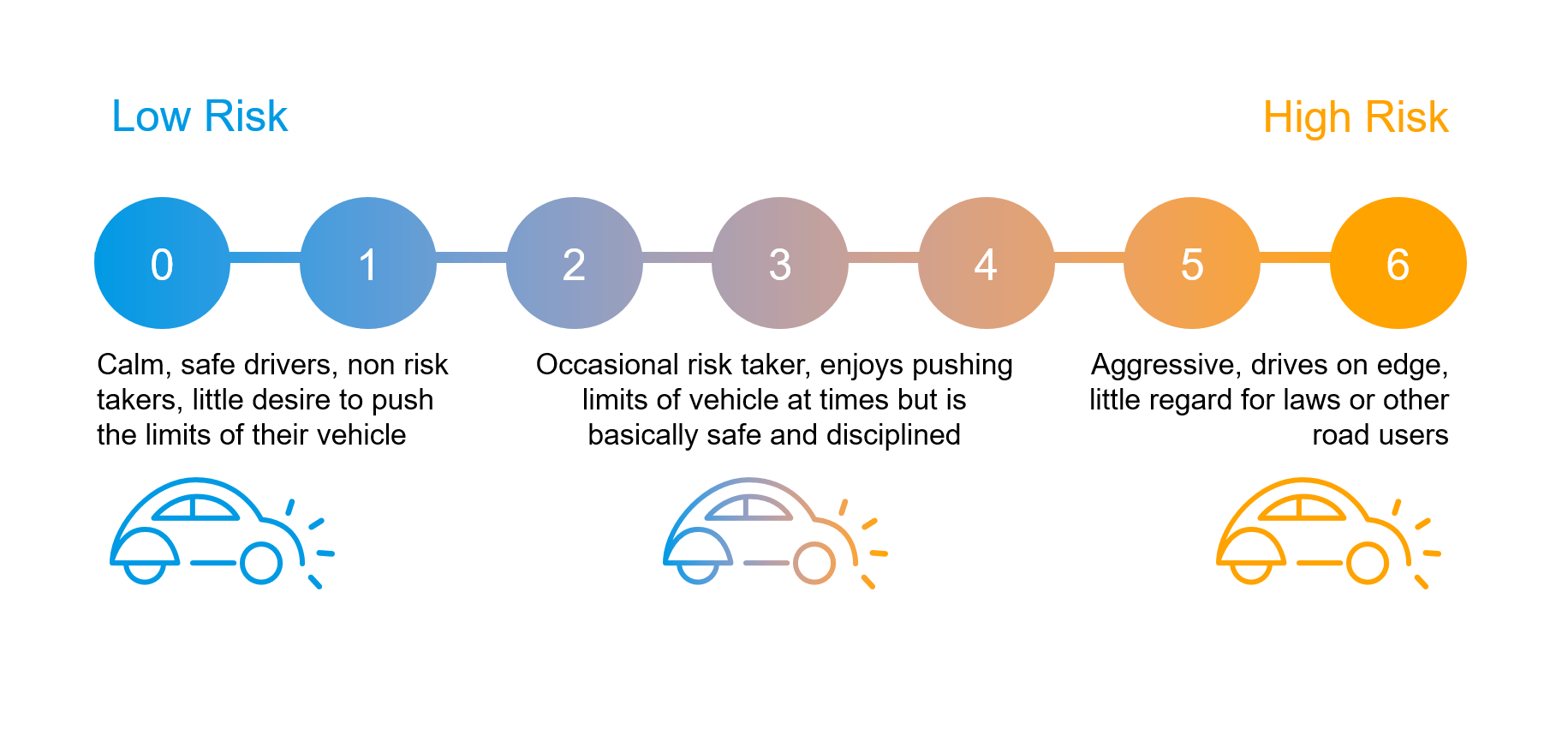

QBE has a scale of zero to six that rates the temperament of drivers — six being high risk (aggressive drivers with little regard for laws and other road users), and zero being low risk (calm, safe drivers who have little desire to push the limits).

Arthur says many accidents can be avoided by employing people who fall into the lower risk categories, and putting initiatives in place to change the attitudes of existing employees in the higher-risk categories.

“The type of drivers you have are very important as far as risk management goes,” he reiterates.

Implementing initiatives to change behaviors may seem like a lot of work for businesses.

But when you factor in the cost of accidents, admin time, and any subsequent time off, it’s work that’s worth investing in.

QBE works with businesses to help reduce vehicle accidents, identify the common causes of accidents, and help train staff to avoid them.

To find out more, contact your QBE representative or your broker.