Speed and simplicity

• c.change/Sunrise online platform to give brokers ease of transactions

• Easy occupation search

Farming is unpredictable, and events beyond your client’s control can have a big impact on their life and livelihood.

QBE Farm Pack has been designed to provide the broad protection farmers need for their personal and business risks, in one streamlined product.

Whether your client has 1,000 head of cattle, or a two-hectare hobby farm, we’ll help you deliver comprehensive cover and outstanding service from quote to claim – so they can get back to work sooner.

With QBE Farm Pack, you can pick and choose from the following covers:

*Benefits listed are subject to terms and conditions. Limits and exclusions apply. To decide if this product is right for you, please refer to the Product Disclosure Statement (PDS) and Target Market Determination (TMD).

From kangaroo accidents to fires in farm buildings, our dedicated claims team is here to help your client get back to work as quickly as possible.

Along with our in-house expertise, we work with a national network of tradespeople and suppliers – so we’ll get things sorted locally when we can.

• c.change/Sunrise online platform to give brokers ease of transactions

• Easy occupation search

• Variable excess options

• Pay-by-the-month premium capabilities with no additional fees

• Enhanced cover limits

• New additional benefits and options

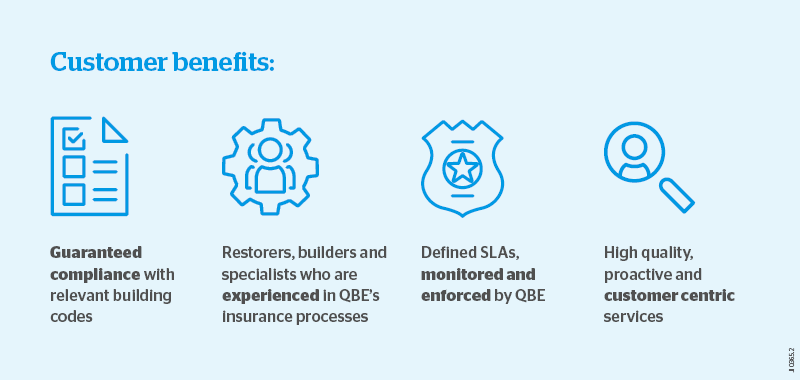

QBE recommended restorers and builders for property claims

When your client's claim requires restoration services or a builder to repair damage to their property, a QBE recommended restorer or builder is a good choice.

We understand that client needs are unique therefore QBE has partnered with a range of suppliers with a strong focus on regional, remote and metro representation, who can offer speciality services relevant to the claim. Our panel has builders that cater for small repairs to customers’ properties all the way to a suite of builders catering for the high complexities of a large commercial loss.

Restoration services

QBE’s panel restorers will mobilise and work quickly to ensure a safe environment for your customers, removing contaminants, returning the environment to a pre-loss state and allowing repair work to begin.

This can include the restoration of removable property to its former condition, or mitigation activities to minimise further damage including drying and mould removal.

Building services

Our building partners cater for simple repairs to customers’ properties all the way to a suite of builders catering for the high complexities of a large commercial loss.

Our relationship with our recommended restorers and builders means they have plenty of experience servicing QBE claims. In addition, we closely monitor the performance of our recommended suppliers to ensure the best outcome for your clients.

You can search for a QBE accredited restorer or builder using the Repairer Finder Tool.

For Businesses

Find a broker