47% of Aussies are risking fire safety: how to avoid bad habits

This article was originally published in June 2021 and has been updated.

- While 97% of Australians surveyed have a smoke alarm, only 21% test them regularly

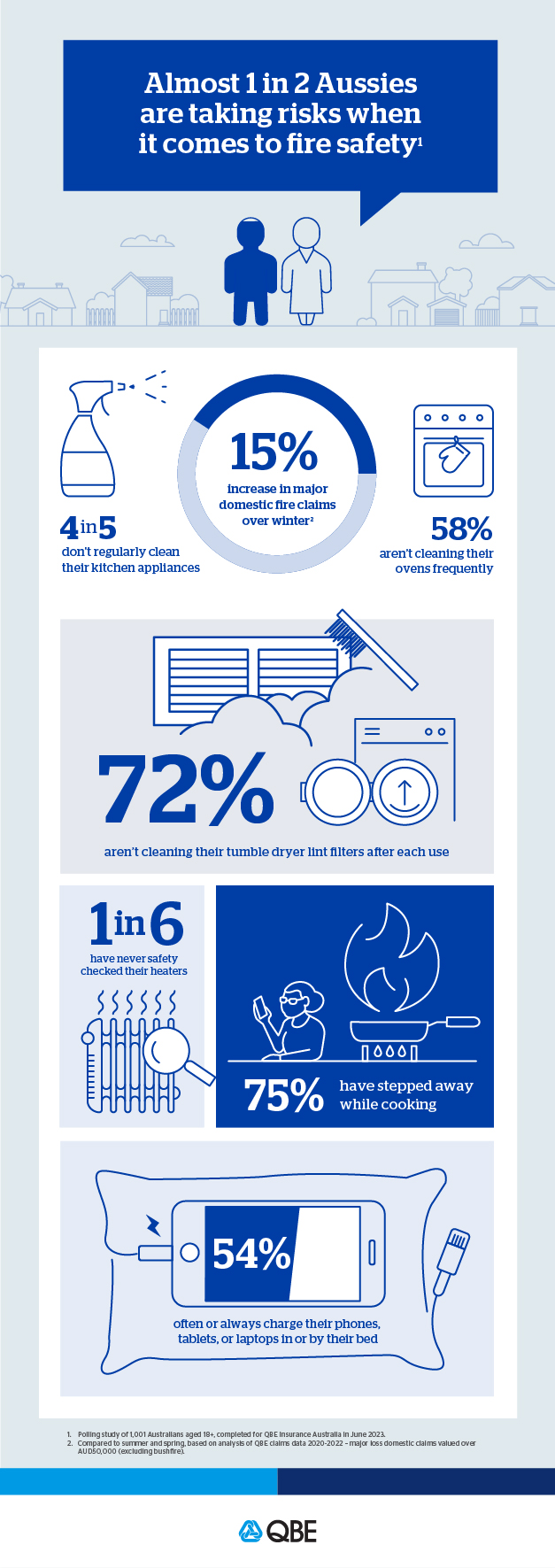

- With home fire claims increasing by an average of 15% in winter1, it’s even more important to take precautions

- Here are five key home fire risks, and how to stay safe during the cooler months.

QBE Insurance is reminding families to stay safe this winter, after research2 revealed 47% of Australians are engaging in behaviour that exposes them to home fire risk.

In the cooler months, many of us are engaging in potentially risky activities to keep warm, says QBE General Manager, Short Tail Claims, Arron Mann.

According to QBE data, winter is also the period when major domestic fire claims volumes typically spike, increasing by 15% on average (compared to summer and spring).

“There are lots of people who don’t even realise there’s a risk, and many that think a fire won’t ever happen to them. That's why it's important to warn people of the dangers, and how to avoid them. We want everyone to stay safe while staying warm."

Risk #1: Forgetting to empty the lint filter in your dryer

72% of Australians aren't cleaning their lint filters after every use, including the 8% who have reportedly never emptied it at all – or can't remember when it was last cleaned.

This is a major household safety risk considering manufacturers and authorities are clear that filters must be cleared after every use – particularly in winter when dryer use increases for many, says Mann.

“The lint produced in the drying process can become a fire hazard if it accumulates in or around your dryer, reducing ventilation and causing overheating. The vent pipe should also be cleaned of lint every three months, or even more regularly if a dryer is used daily."

The research also revealed 32% of Australians regularly or occasionally leave the dryer running when they leave home – another risky habit according to Mann.

“Someone should always be close by if a dryer is running – it could be the difference between a fire being extinguished quickly versus a home being destroyed.”

Risk #2: Not doing safety checks on heaters

56% of Australians are using gas and electric heaters to stay warm, but one in six have never safety checked their heaters which is a major red flag, says Mann.

“All heaters should be inspected regularly at the start of every winter – electrical and gas heaters are behind thousands of claims each year.

“Check electric heaters are in good working condition, including the receptacle, power cord and wiring, and ensure only one heater is used per electrical circuit.

“Gas heaters should be serviced at least every two years by a licenced gasfitter and tested for carbon monoxide spillage. Rusted reflectors or frames can create hotspots that can cause problems.

“Outdoor heaters, fireplaces and firepits should also be checked and never left unattended – about one in five home major fire damage claims start outside the main dwelling.”

Risk #3: Ducking away while cooking

Three in four Australians have stepped away while cooking and 13% admit to doing it all the time.

Ducking away for just a moment may seem harmless, but leaving cooking unattended is a leading cause of home fires in Australia. Kitchen fires are behind about one in five of all fire damage claims, says Mann.

A substantial 37% of Aussies report they cook more in winter, so the chance of a kitchen fire is naturally higher.

"Kitchens are full of flammable materials and appliances that deal with heat and grease. Stepping away even for just a minute can lead to a fire, causing tens of thousands of dollars in damage. That’s why it’s important to stay in the kitchen while cooking.

“Turn off and unplug electric appliances when they're not in use as they continue to draw power even when they're off, so if the wiring is old or faulty, a fire could ignite.”

Risk #4: Not regularly cleaning your kitchen

Almost one in two Australians don't regularly clean kitchen appliances, while 58% don't clean their ovens as recommended. With winter cooking ramping up, neglected kitchens could become hazardous, says Mann.

“Grease, grime, or crumbs accumulating can seem harmless, but a build-up can become a hazard – particularly when it comes to ovens.

"Empty the crumb tray in toasters regularly. Clean the oven and barbeque at least every three months. Wipe out the microwave often."

Risk #5: Limited readiness to deal with a fire

Research also revealed some Australians aren't as prepared to deal with a fire as they could be. While 81% have a fire blanket or extinguisher in their homes, a significant 68% report they don’t have a fire evacuation plan.

Basics like fire blankets and extinguishers, establishing an evacuation plan, testing smoke alarms regularly and changing batteries as recommended are key, says Mann.

“Fire is a unique risk and if action is taken to address the risk very early, it can result in little or no damage. If it’s not, a fire at home can be a catastrophic event. Fire blankets, extinguishers and evacuation plans can save homes and lives.

“Many of us also know the benefits that smoke detectors have in not only saving property but more importantly saving lives. If you haven’t tested them and checked the batteries recently, now’s the perfect time.”

How home insurance can help after a fire

Insurance can provide financial protection against domestic fire, so considering cover and keeping it up to date is key, says Mann.

“Almost all home and contents policies include cover for fires at home, and sometimes, despite preparation efforts, a fire event can be unavoidable.

“Our policies include cover for temporary accommodation if a home is left unliveable after a fire event, as well as for liability, which can help if a fire in your home leaves you liable for damage to a neighbouring property.

“It‘s a good idea for policyholders to check they have adequate home and contents insurance cover and that their sum insured, the value of replacing the house and contents, is up to date.”

Home Insurance provides cover for homeowners’ building and contents, while renters and strata owner-occupiers can choose Contents Insurance protection.

1 Polling study of 1,001 Australians aged 18+, completed for QBE Insurance Australia in June 2023.

2 Compared to summer and spring, based on analysis of QBE claims data 2020-2022 – major loss domestic claims valued over AUD50,000 (excluding bushfire).