What you need to know about making an extreme weather insurance claim

One of the most critical parts of extreme weather preparation is ensuring you have the correct home insurance policy and a clear understanding of exactly how you’re covered.

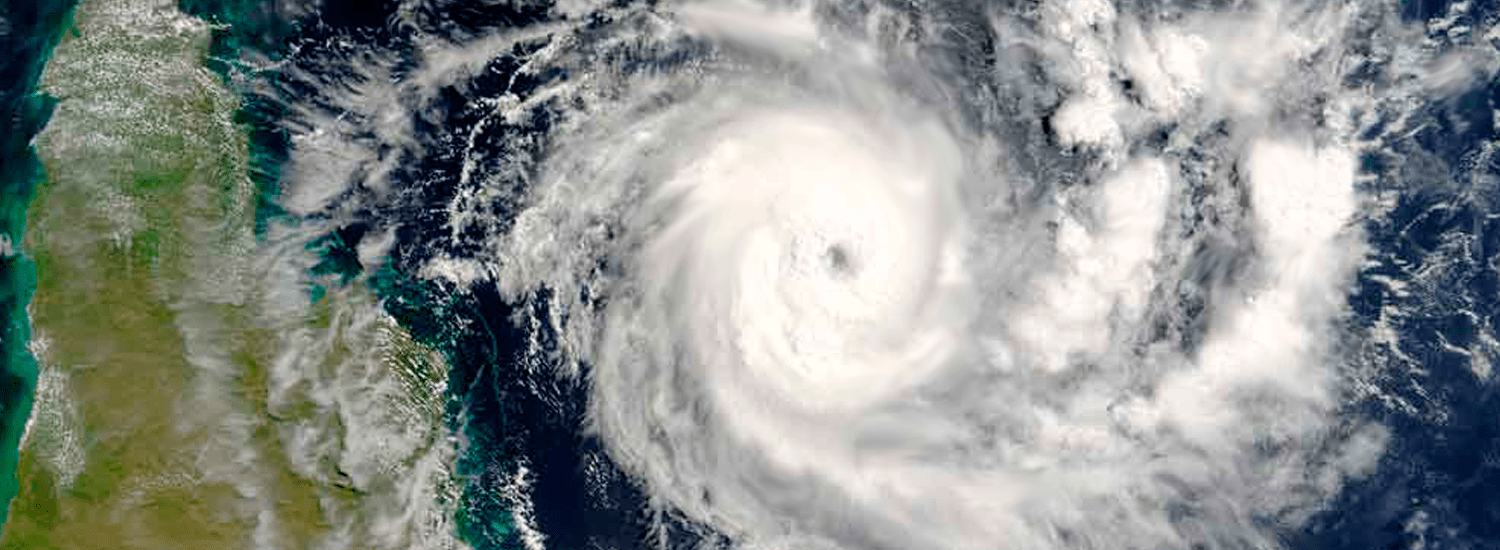

Natural disasters and extreme weather are unpredictable and unfortunately may be more likely to effect certain locations.

If you live in an area that’s prone to bushfire, severe storms or cyclones, it’s worthwhile considering the role your insurance cover may play in getting you back to normal, especially if you need to make a claim.

There are a number of proactive steps homeowners can take now to prepare for an extreme weather claim.

1. Know your insurance policy

Make sure you read your insurance policy and Product Disclosure Statement (PDS) or policy wording from top to bottom and truly understand it.

Start at the table of contents as it provides an overview of the policy and can guide you to specific areas of the document you may not understand or need to clarify.

“Insurance policy wordings can often use language with special meanings. Our Product Disclosure Statement (PDS) has a section that acts as a glossary for these words. It’s helpful to have a read through these definitions early on,” says QBE’s Arron Mann, General Manager of Short Tail Claims.

“And if you have any questions, we’re available on 133 723 or you can seek advice from your insurance broker or agent.”

It’s a good idea to have all the details you need to begin the claims process on hand, starting with the correct phone number to lodge the claim or contact details of your insurance broker or agent, Mann says. “We’re open 24 hours a day, seven days a week for claim lodgement,” Mann adds.

“A good way to have these key contact details handy is to create a new contact in your mobile phone or bookmark the web address where you can lodge an online claim,” he says

Eighty-one per cent of homeowners and renters in Australia are exposed to significant loss because their insurance doesn’t cover them to resume the same standard of living if a crisis happens.

So now is the time to revisit your policy specifics and your sum insured. While every policy is different, ensuring your sum insured reflects the value of your property and assets is important. For some policies, there may be other benefits that come into play, such as providing temporary accommodation so it’s always best to go back to your PDS and check.

“Your sum insured is a value that should be consistent with replacing your entire home. Underinsurance can leave you with a short fall of costs to rebuild your home, and most mortgages have clauses that require adequate insurance cover as part of the mortgage contract”, says Mann.

“Too often we find that people underestimate the importance of their sum insured and take shortcuts to achieve a lower premium, but this can leave people exposed to being underinsured in a crisis. An accurate sum insured comes down to valuing your home and your belongings correctly.”

One in ten people insuring their home based on their own estimate, deliberately under-valued their building or contents to lower their premium, according to research by the Insurance Council of Australia (ICA).

“When calculating your sum insured make sure you take into account the replacement costs of items and fixtures, preparing land and foundations and understanding that costs must be new for old at today’s prices,” Mann says.

To help our customers work out their sum insured we’ve built calculators as a guide, says Mann. These take into account extra costs that may not be obvious, for example, removing debris could add 10-15 per cent to your sum insured.

“Some policies automatically account for inflation for your sum insured but it’s best not to rely on this as your sole safeguard,” Mann says.

Another tip is to speak to a reputable builder and get a current quote for the cost of a complete rebuild of your home.

The Housing Industry Association (HIA) may be able to help you find a builder. As the peak national body representing construction and property development in Australia, their tradesperson membership provides an extensive list of builders that abide to the HIA’s code of ethics, indicating a high level of professionalism.

This helpful checklist can help you in the process of choosing a home insurance policy that’s fit for your needs.

2. Understand your policy exclusions

What won’t your home and contents insurance policy cover? This section of your Product Disclosure Statement (PDS) is crucial.

For example, if your home is under renovations, you may not be covered by a standard home insurance policy.

Spend some time reading and understanding your policy exclusions and if in doubt contact QBE on 133 723 or your broker or agent to discuss your particular situation.

3. Take photos of your home and belongings

Now is the time to make sure your home is properly maintained. That is, structurally sound, watertight and in a good state of repair.

An easy way to keep a record of your belongings and the state of your home is to take photos, Mann says.

“Having images that capture the condition of your home could be helpful in the claims process. Photos are ideal because they prove the existence of your items, but most importantly, the condition prior to the event.”

“Take photos of the ceiling, walls, floor, fittings and fixtures and the full area surrounding your property. As these are at a point in time, consider retaking the photos each year when you receive your insurance renewal notice.”

To be thorough, take photos of your personal belongings also.

“You could take photos of important receipts too,” Mann suggests. “Receipts can fade over time or get mislaid or could be ruined or completely lost after water damage or in a fire.”

4. Remember we’re here to help

As difficult as it may be, you may need to be patient if you’re affected by an extreme weather event that has caused widespread damage to the area in which live, for example, in the case of a cyclone or storm that causes a lot of localised damage.

“Always remember we’re here to help and the most important priority is your safety, which is why we ask you to follow all emergency services advice and look out for yourself and your family first."

We have an established panel of licenced builders, repairers and assessors to respond to our customers when they need us most.

“Once we hear from you, we come up with and coordinate a tailored course of action using these resources to deliver the best outcome for our customers. For example, a property that has a damaged roof from a storm may need to be made safe or undergo temporary repairs until more extensive repairs can be completed,” explains Mann.

“Working directly with these service providers is a key advantage for our customers because it means having their property restored or replaced as quickly as possible.”

Why you need to know about extreme weather in Australia

With the onset of extreme weather season in Australia, now’s the time to take the necessary precautions to protect your family, home and belongings.

Bushfires and severe storms, including hail storms, are increasing in frequency and severity.

Planning for this weather is important as it will help to keep your family safe and lower the risk of damage to your property.

There’s plenty home owners can do to prepare, including retrofitting your home for spot fire and ember attack, clearing your gutters of leaves and twigs and drawing up an evacuation plan.